February 16, 2017 by CDR Blog and Chain Drug Review

Abbott "Tad" Lipsky, Federal Trade Commission, Fred's, FTC Bureau of Competition, Maureen Ohlhausen, New York Post, Walgreens-Rite Aid deal, Walgreens-Rite Aid merger

CDR Blog

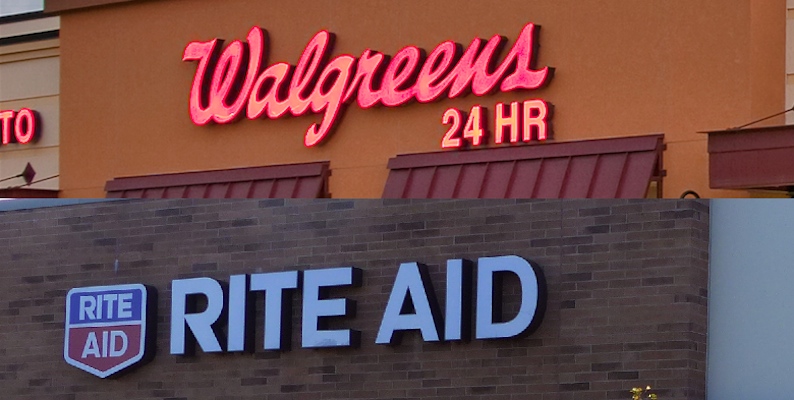

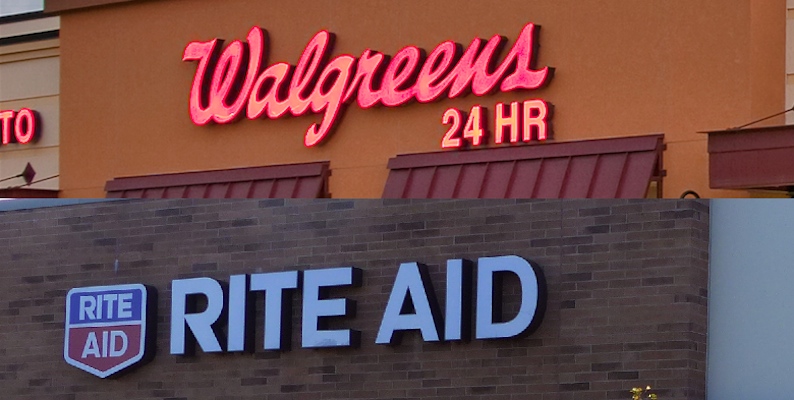

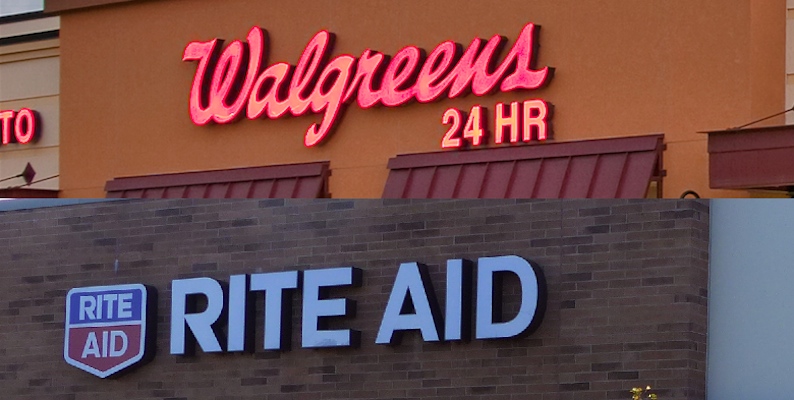

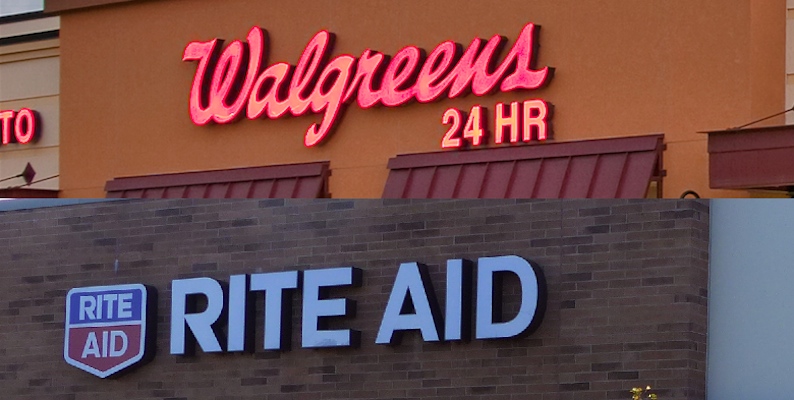

After being announced well over a year ago and endless speculation, it looks like the Federal Trade Commission is set to sign off on Walgreens Boots Alliance’s planned acquisition of Rite Aid Corp. The New York Post reported late Wednesday evening that WBA is bullish that it’s latest store divestiture proposal will sway the FTC

February 6, 2017 by Chain Drug Review

drug store marketplace, Federal Trade Commission, Fred's, Rite Aid, Rite Aid stores, Walgreens Boots Alliance, Walgreens-Rite Aid merger

Business, Leading Headlines, Retail News

MEMPHIS, Tenn. — Fred’s Inc. has amended a revolving credit facility in the event that it must acquire additional Rite Aid stores in connection with the pending Walgreens-Rite Aid merger. According to a filing with the Securities and Exchange Commission, Fred’s is increasing its revolving loan commitment to $225 million from $150 million. Among other

February 6, 2017 by Geoff Walden and Chain Drug Review

CVS Health, David Denton, Edith Ramirez, Federal Trade Commission, Fred's, Maureen Ohlhausen, Rite Aid, Stefano Pessina, Terrell McSweeny, Walgreens Boots Alliance, Walgreens-Rite Aid merger

2017, Issue 02-06-2017, Issues, News

WASHINGTON — The acquisition of Rite Aid Corp. by Walgreens Boots Alliance (WBA) Inc. remained unconsummated after WBA’s plan to divest 865 stores failed to erase antitrust regulators’ competitive concerns. When the Friday, January 27, deadline for completing the Walgreens-Rite Aid merger deal arrived, the Federal Trade Commission still hadn’t cleared the transaction, despite the

January 31, 2017 by Chain Drug Review

Cerberus Capital Management, Federal Trade Commission, Fred's, Fred's Pharmacy, Rite Aid, Walgreens Boots Alliance, Walgreens-Rite Aid merger

Business, Featured Articles, Leading Headlines, Retail News

MEMPHIS, Tenn. — Fred’s Inc. has reaffirmed its $950 million deal to buy 865 Rite Aid stores to be divested for antitrust clearance of Walgreens Boots Alliance’s pending acquisition of Rite Aid Corp. Fred’s said late Monday that “the asset purchase agreement it entered into on Dec. 19, 2016, with Walgreens and Rite Aid remains

January 27, 2017 by CDR Blog and Chain Drug Review

Cerberus Capital Management, Federal Trade Commission, Fred's, Rite Aid, Walgreens, Walgreens Boots Alliance, Walgreens-Rite Aid merger

CDR Blog

As the clock winds down on today’s deal end date for the Walgreens-Rite Aid merger, a report of a new potential player has emerged. Citing anonymous sources, the New York Post reported Friday that private equity firm Cerberus Capital Management has expressed interest in the 865 Rite Aid stores that Walgreens Boots Alliance and Rite

January 20, 2017 by CDR Blog and Chain Drug Review

Federal Trade Commission, Fred's, Rite Aid, Rite Aid shares, Walgreens, Walgreens Boots Alliance, Walgreens-Rite Aid merger

CDR Blog

Trading of Rite Aid shares was briefly halted on the New York Stock Exchange on Friday when the stock price sank following published reports that the Federal Trade Commission is iffy about antitrust concessions for approval of the Walgreens-Rite Aid merger. Rite Aid shares suspended trading after dropping 18% but resumed minutes later, TheStreet.com reported.

November 9, 2016 by CDR Blog and Chain Drug Review

Deutsche Bank Securities, Federal Trade Commission, George Hill, private equity, Rite Aid, Stefano Pessina, Walgreens Boots Alliance, WBA-Rite Aid merger

CDR Blog, Leading Headlines

Walgreens Boots Alliance and Rite Aid recently extended the agreement end date for their merger transaction until late January, with the expectation that the deal will get the Federal Trade Commission’s OK in early 2017. As WBA’s store divestiture talks with the FTC roll on, Deutsche Bank Securities analyst George Hill shed some light on

November 7, 2016 by Geoff Walden and Chain Drug Review

CVS Health, Deutsche Bank Securities, Federal Trade Commission, George Hill, Kroger, Rite Aid, Stefano Pessina, Walgreens Boots Alliance, Walmart, WBA-Rite Aid merger

2016, Issue 11-07-2016, Issues, News

DEERFIELD, Ill. — Walgreens Boots Alliance Inc. (WBA) and Rite Aid Corp. have extended the time frame for completing their planned $17.2 billion merger. The companies have pushed back the end date for the deal by three months to January 27, and they expect the transaction to close early next year. Both companies had the

October 10, 2016 by Geoff Walden and Chain Drug Review

CVS, Federal Trade Commission, FTC, Kroger, Rite Aid, Stefano Pessina, Walgreens, Walgreens Boots Alliance, WBA, WBA-Rite Aid

2016, Issue 10-10-2016, Issues, News

NEW YORK — Speculation continues to percolate about snags holding up Walgreens Boots Alliance Inc.’s (WBA’s) acquisition of Rite Aid Corp. Last last month the New York Post reported that private equity firms were uninterested in purchasing 650 stores that WBA must divest to satisfy antitrust requirements. Investors found the stores to be subpar and

September 29, 2016 by CDR Blog and Chain Drug Review

chain drug industry, CVS, Federal Trade Commission, Kroger, Rite Aid, Scott Mushkin, Walgreens Boots Alliance, Walmart, WBA, Wolfe Research

CDR Blog

It looks like one divestment possibility for Walgreens Boots Alliance isn’t panning out as it works with the Federal Trade Commission to gain antitrust clearance for its acquisition of Rite Aid. The New York Post reported this week that WBA hasn’t been able to sway private equity firms to buy a chunk of Walgreens and/or

September 26, 2016 by Geoff Walden and Chain Drug Review

Federal Trade Commission, Kroger, Rite Aid, Rite Aid acquisition, Walgreens Boots Alliance

2016, Issue 09-26-2016, Issues, News

DEERFIELD, Ill. — Walgreens Boots Alliance Inc. (WBA) has upped the number of stores that it expects to divest to gain government clearance for its $17.2 billion purchase of Rite Aid Corp. WBA said this month that between 500 and 1,000 Walgreens and/or Rite Aid stores will probably have to be divested to win Federal

September 8, 2016 by Chain Drug Review

Federal Trade Commission, Rite Aid, Stefano Pessina, Walgreens Boots Alliance

Business, Featured Articles, Leading Headlines, Retail News

DEERFIELD, Ill. — Walgreens Boots Alliance (WBA) said it’s working on store divestiture scenarios with the Federal Trade Commission to gain clearance for its $17.2 billion deal to acquire Rite Aid Corp. WBA said Thursday that it and Rite Aid “remain actively engaged” in talks with the FTC as the regulator reviews the acquisition, which

August 6, 2016 by Jeffrey Woldt and Chain Drug Review

Ahold, Delhaize, Federal Trade Commission, Jeffrey Woldt, Ornella Barra, Rite Aid, Stefano Pessina, Walgreens, Walgreens Boots Alliance, Walgreens-Rite Aid merger, WBA

2016, Featured Articles, Issue 08-08-2016, Issues, Leading Headlines, Opinion

It has been slightly more than nine months since Walgreens Boots Alliance agreed to acquire Rite Aid in a $17.2 billion all-cash transaction. Since that time, speculation about whether the Walgreens-Rite Aid merger will pass muster with the Federal Trade Commission has become a staple of discussion for people involved in community pharmacy and the

July 15, 2016 by CDR Blog

Federal Trade Commission, FTC, Rite Aid, Scott Mushkin, Stefano Pessina, Walgreens Boots Alliance, Wolfe Research

CDR Blog, Leading Headlines

It looks like Walgreens Boots Alliance is getting down to brass tacks in its negotiations with the Federal Trade Commission to acquire Rite Aid. The New York Post reported late Thursday evening that WBA is discussing store divestitures with the FTC and trying to get a bead on the number of Walgreens and/or Rite Aid